All Categories

Featured

Table of Contents

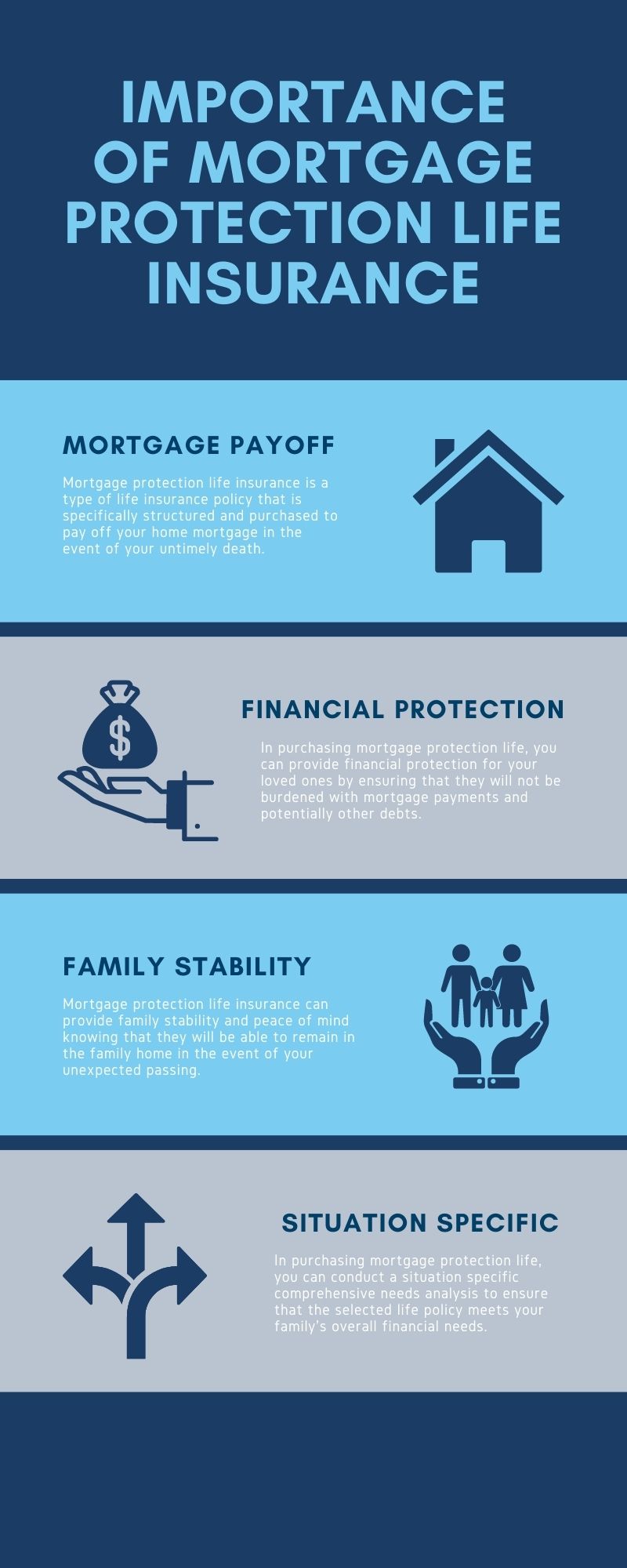

Home loan life insurance policy provides near-universal protection with marginal underwriting. There is usually no medical checkup or blood example needed and can be an important insurance policy alternative for any house owner with serious pre-existing clinical conditions which, would certainly stop them from getting standard life insurance policy. Various other advantages consist of: With a home mortgage life insurance policy in place, beneficiaries will not have to worry or question what could occur to the family home.

With the home mortgage repaid, the household will always belong to live, offered they can pay for the residential or commercial property tax obligations and insurance every year. best payment protection insurance.

There are a couple of different kinds of mortgage defense insurance, these include:: as you pay more off your home loan, the amount that the policy covers decreases according to the impressive balance of your home loan. It is the most usual and the most inexpensive kind of mortgage protection - life insurance house mortgage.: the amount guaranteed and the costs you pay stays level

This will certainly settle the home loan and any kind of staying balance will most likely to your estate.: if you wish to, you can include serious ailment cover to your mortgage protection policy. This indicates your home loan will certainly be cleared not just if you pass away, yet additionally if you are identified with a significant disease that is covered by your policy.

Online Mortgage Insurance

In addition, if there is a balance remaining after the home loan is cleared, this will certainly most likely to your estate. If you change your mortgage, there are numerous points to think about, depending upon whether you are covering up or prolonging your mortgage, switching, or paying the home loan off early. If you are covering up your mortgage, you need to make certain that your plan satisfies the brand-new worth of your home loan.

Contrast the prices and benefits of both choices (when do i need mortgage insurance). It may be cheaper to keep your original home loan defense plan and afterwards acquire a second policy for the top-up amount. Whether you are covering up your home mortgage or expanding the term and require to get a brand-new policy, you may find that your costs is greater than the last time you secured cover

Where To Buy Mortgage Protection Insurance

When changing your home loan, you can appoint your home loan defense to the brand-new lender. The premium and degree of cover will certainly be the very same as before if the quantity you obtain, and the regard to your home loan does not change. If you have a policy via your lender's group system, your loan provider will certainly cancel the plan when you switch your home loan.

There will not be an emergency where a large bill is due and no way to pay it so right after the fatality of a liked one. You're offering assurance for your family members! In The golden state, home loan security insurance coverage covers the entire superior equilibrium of your loan. The fatality benefit is a quantity equivalent to the balance of your mortgage at the time of your passing away.

Cheap Loan Insurance

It's necessary to comprehend that the survivor benefit is offered directly to your creditor, not your liked ones. This ensures that the continuing to be debt is paid completely which your loved ones are spared the economic strain. Home mortgage defense insurance can likewise provide momentary coverage if you come to be impaired for an extensive duration (generally 6 months to a year).

There are many benefits to getting a home mortgage protection insurance plan in California. Some of the leading advantages include: Assured approval: Also if you're in poor health and wellness or operate in a harmful profession, there is assured authorization without medical examinations or laboratory examinations. The exact same isn't true for life insurance coverage.

Special needs protection: As stated over, some MPI plans make a couple of mortgage payments if you come to be handicapped and can not generate the exact same revenue you were accustomed to. It is necessary to note that MPI, PMI, and MIP are all different kinds of insurance. Mortgage defense insurance (MPI) is developed to settle a mortgage in case of your fatality.

Home Loan Insurance In Case Of Death

You can even use online in mins and have your plan in place within the very same day. For additional information about getting MPI insurance coverage for your mortgage, get in touch with Pronto Insurance coverage today! Our knowledgeable representatives are below to address any questions you may have and provide more help.

MPI supplies a number of advantages, such as peace of mind and simplified credentials processes. The death advantage is directly paid to the lender, which limits versatility - credit life on home mortgage. In addition, the benefit amount lowers over time, and MPI can be more costly than common term life insurance plans.

Mortgage Protection Against Unemployment

Get in fundamental information about on your own and your home mortgage, and we'll contrast prices from various insurers. We'll additionally show you just how much coverage you need to shield your home loan.

The primary benefit below is clearness and confidence in your choice, understanding you have a plan that fits your needs. As soon as you accept the plan, we'll handle all the paperwork and arrangement, making certain a smooth application process. The favorable outcome is the satisfaction that includes understanding your family is protected and your home is safe, no matter what happens.

Professional Advice: Support from seasoned professionals in insurance policy and annuities. Hassle-Free Arrangement: We manage all the documentation and application. Affordable Solutions: Locating the best coverage at the cheapest possible cost.: MPI particularly covers your home mortgage, giving an additional layer of protection.: We function to find one of the most cost-effective solutions tailored to your budget plan.

They can supply details on the insurance coverage and benefits that you have. Usually, a healthy and balanced person can expect to pay around $50 to $100 monthly for mortgage life insurance coverage. Nevertheless, it's suggested to obtain a personalized mortgage life insurance policy quote to get an accurate quote based upon specific circumstances.

Latest Posts

Cheapest Funeral Policy

Final Expense Vs Whole Life

Does Life Insurance Pay For Funeral Expenses