All Categories

Featured

Table of Contents

Home mortgage life insurance policy provides near-universal coverage with minimal underwriting. There is commonly no medical exam or blood example required and can be a valuable insurance coverage alternative for any home owner with major pre-existing clinical conditions which, would avoid them from purchasing typical life insurance. Other benefits include: With a home loan life insurance policy plan in location, beneficiaries won't have to worry or question what could happen to the family home.

With the home mortgage repaid, the family members will always have a location to live, offered they can manage the home tax obligations and insurance coverage annually. mortgage protection insurance lead.

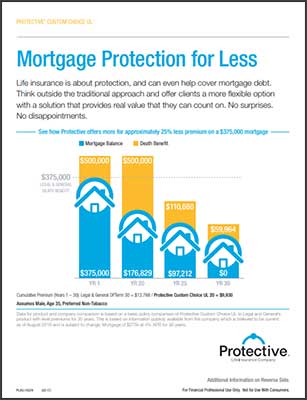

There are a couple of various sorts of mortgage security insurance policy, these consist of:: as you pay even more off your mortgage, the quantity that the policy covers lowers in line with the superior balance of your home loan. It is the most common and the least expensive type of mortgage protection - is homeowners insurance and mortgage insurance the same.: the amount insured and the premium you pay stays degree

This will certainly pay off the home mortgage and any remaining balance will certainly most likely to your estate.: if you want to, you can include severe disease cover to your mortgage defense policy. This suggests your home mortgage will certainly be removed not only if you die, but also if you are diagnosed with a severe illness that is covered by your policy.

Mortgage Life Cover

Furthermore, if there is an equilibrium remaining after the home loan is cleared, this will go to your estate. If you transform your home loan, there are a number of points to take into consideration, relying on whether you are topping up or expanding your home mortgage, changing, or paying the home mortgage off early. If you are covering up your home mortgage, you require to make certain that your plan fulfills the brand-new worth of your home loan.

Contrast the expenses and benefits of both choices (insurance house payment). It may be less costly to maintain your original home mortgage security policy and after that purchase a second plan for the top-up quantity. Whether you are covering up your home loan or prolonging the term and require to obtain a brand-new policy, you might locate that your premium is greater than the last time you obtained cover

Mortgage Protection Plans Are They Worth It

When changing your home mortgage, you can assign your mortgage protection to the new lender. The costs and degree of cover will certainly coincide as before if the amount you obtain, and the regard to your home mortgage does not transform. If you have a plan with your lender's team system, your loan provider will cancel the plan when you change your home loan.

There will not be an emergency where a large bill schedules and no chance to pay it so soon after the fatality of an enjoyed one. You're offering peace of mind for your family! In The golden state, mortgage protection insurance coverage covers the whole outstanding equilibrium of your funding. The survivor benefit is a quantity equal to the balance of your home mortgage at the time of your passing away.

Mortgage Protection Group

It's vital to recognize that the fatality advantage is provided directly to your financial institution, not your enjoyed ones. This ensures that the continuing to be debt is paid in full which your loved ones are saved the financial pressure. Home loan defense insurance can also supply short-term coverage if you end up being handicapped for an extended period (typically 6 months to a year).

There are many benefits to getting a home mortgage security insurance coverage policy in California. A few of the leading advantages consist of: Ensured approval: Even if you remain in poor health or operate in an unsafe occupation, there is guaranteed approval with no medical examinations or lab tests. The exact same isn't real forever insurance.

Impairment defense: As specified above, some MPI plans make a couple of home loan repayments if you become handicapped and can not generate the very same revenue you were accustomed to. It is necessary to note that MPI, PMI, and MIP are all various types of insurance coverage. Mortgage protection insurance (MPI) is created to settle a home mortgage in instance of your death.

Mortgage Cover For Death

You can even apply online in mins and have your plan in position within the exact same day. For additional information concerning obtaining MPI insurance coverage for your mortgage, get in touch with Pronto Insurance policy today! Our educated agents are here to respond to any type of questions you might have and supply additional aid.

It is suggested to contrast quotes from various insurance companies to locate the very best rate and insurance coverage for your needs. MPI provides several advantages, such as satisfaction and streamlined credentials processes. It has some restrictions. The fatality advantage is directly paid to the loan provider, which restricts versatility. In addition, the advantage amount reduces in time, and MPI can be extra pricey than typical term life insurance policy policies.

Credit Insurance Mortgage

Go into standard information about on your own and your home mortgage, and we'll contrast rates from different insurance providers. We'll also reveal you just how much coverage you require to protect your home mortgage.

The major advantage right here is quality and self-confidence in your choice, recognizing you have a plan that fits your requirements. As soon as you accept the strategy, we'll handle all the documents and configuration, making sure a smooth execution procedure. The positive result is the comfort that includes recognizing your family is shielded and your home is protected, whatever happens.

Professional Suggestions: Support from experienced specialists in insurance and annuities. Hassle-Free Configuration: We handle all the documents and implementation. Affordable Solutions: Discovering the best insurance coverage at the most affordable feasible cost.: MPI especially covers your home mortgage, providing an added layer of protection.: We work to locate one of the most affordable solutions tailored to your budget.

They can supply info on the insurance coverage and advantages that you have. Generally, a healthy and balanced individual can anticipate to pay around $50 to $100 each month for home mortgage life insurance policy. It's suggested to obtain an individualized home loan life insurance quote to obtain an accurate price quote based on specific circumstances.

Latest Posts

Cheapest Funeral Policy

Final Expense Vs Whole Life

Does Life Insurance Pay For Funeral Expenses